Effective project management is crucial for the success of any endeavor, but certainly for organizations looking to achieve operational and financial efficiency. Among the many facets of project management, financial management stands out as a critical component.

This blog explores six project management best practices and the tools used to streamline financial processes, including project-level financials, benchmark budgets, and ongoing project forecasts. Paradigm’s project managers and delivery teams have adopted these practices, leveraging the right tools to ensure better financial control, accurate forecasting, and improved project outcomes for the benefit of all our clients.

The Best Practices

To effectively manage project finances, project-level financials (or engagement summaries) provide a comprehensive overview of income, expenses, and cash flow throughout the project’s lifecycle. Key best practices include:

- Develop a detailed project budget that encompasses all anticipated costs. Project budgets should be reviewed by all internal stakeholders prior to committing to an engagement. Prepare these budgets or proformas with a consistent framework. But remain flexible enough to account for the complexities that accompany your organization’s type of engagements.

- Regularly track and update financial data for accurate and ongoing visibility into project expenses and profitability. Certain systems can provide real-time updates, but bi-monthly or monthly may be more appropriate for small to mid-size professional service companies depending on the systems available. Direct costs should be pulled from their original sources to the extent possible (such as payroll data or travel expense reporting). But, all allocated costs, such as overheads or taxes may use formulaic assumptions updated on a quarterly or annual basis to remain consistent and comparable across engagements.

- Remember, projects don’t always go as planned. Forecast tools should be provided to delivery teams to allow for amended project completion paths and track how those amendments will affect overall profitability of the project.

- Review, review, review. Conduct periodic financial reviews to assess project performance against budgeted targets. Hint: This could be the most important step in the process. Tools mean nothing if they are not used! ?

- Provide stakeholders with updates and insights. Utilize financial reports to communicate project financial status to internal and external stakeholders at key points during, and certainly at the end of, each engagement.

- Leverage comprehensive project management software to assist in tracking project-level financials, budgeting, proformas, and ongoing engagement forecasting. Excel can be used for smaller organizations with smaller engagement quantities, but there are inherent limitations with regards to the volume of data with which Excel can process. To ensure consistency, accountability, and scalability, project management systems should be seriously considered to manage and coordinate engagements.

The Proof is in the Pudding

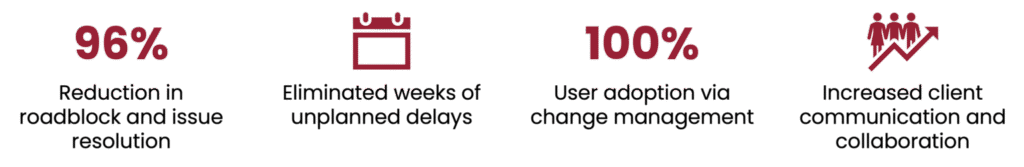

Project management impact goes beyond financials. Effective project and financial management should also positively impact a variety of operational processes. Following the best practices listed above, Paradigm’s project managers have significantly impacted countless clients and countless projects. We recently supported a global leader in home and security solutions:

Effective financial management is a cornerstone of successful project management. By implementing project-level financials, benchmark budgets, and maintaining forecasts, project managers can better control project finances and improve project outcomes. Further leveraging project management tools and integrating them with financial management systems and business intelligence tools further enhances financial visibility and enables informed decision-making.

Learn more about how Paradigm will use these tools and practices every day to manage effective and efficient engagements for you!

Michael Stell, Chief Financial Officer