ServicesFinancial Services

overview

Transform your Financial Services Organization with AI

The financial sector generates massive volumes of data at unprecedented speed, making AI a natural fit for scaling analysis and decision automation. Yet deploying AI in finance requires navigating strict privacy, transparency, and regulatory expectations – while minimizing trade-offs between accuracy, latency, and operational risk. Paradigm brings proven experience delivering AI solutions under these exact constraints, ensuring compliance, clarity, and high-performance outcomes.

Paradigm Services

Our Services & Industries We Empower

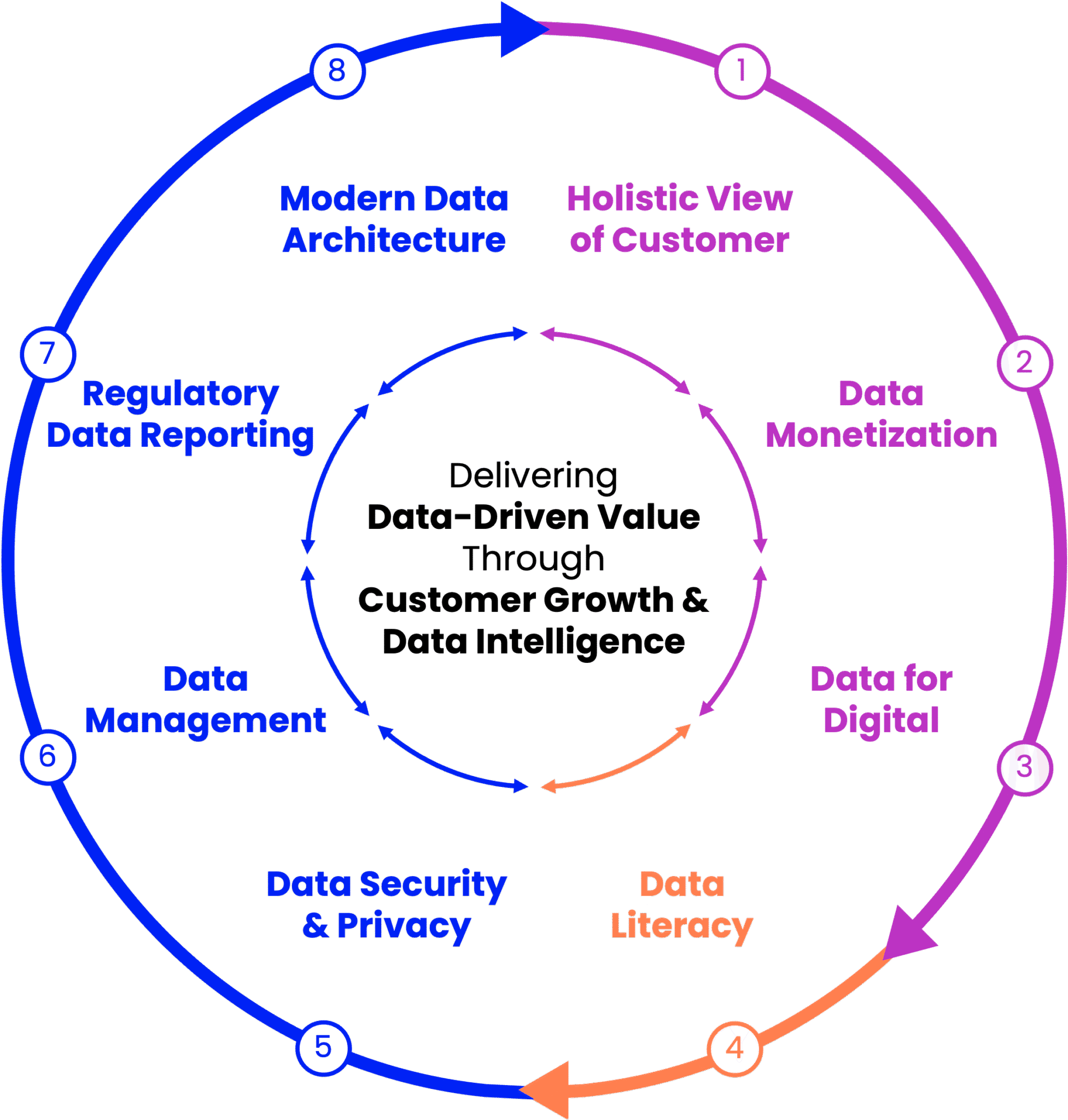

Holistic View of Clients and Customers

- Increase revenue by identifying and expanding relationships with high-value clients

- Reduce servicing costs by offboarding unprofitable or dormant accounts

- Improve risk posture with enhanced transparency for Perpetual KYC

- Accelerate time-to-insight with a clear view of customer behavior and value

Data Commercialization

- Generate new revenue streams by monetizing existing data assets

- Improve product relevance and customer engagement through tested propositions

- Maximize ROI with scalable data products built for repeatable value

- Strengthen competitive edge with insight-driven offerings

Regulatory Data Reporting

- Achieve “Fully Compliant” or “Largely Compliant” status for key regulations

- Reduce reporting costs through improved data quality and governance

- Increase transparency and audit readiness with clear data lineage

- Align ESG and regulatory reporting with broader transformation initiatives

Driving Digital Transformation in Financial Services

Actionable insights on performance, growth, and optimization have become more efficient and cost-effective – putting more accurate, timely information in the hands of decision-makers. Today’s market conditions and regulatory pressures require a different, practical approach to addressing management’s need to know more.

To meet evolving needs in a data-first, cloud-driven world, financial leaders must undergo business process transformation and focus on shifting the enterprise with data-centric infrastructure and strategic direction.

Case Studies

Client Success Stories

What our Client Say

Learn how you can amplify your impact with Data and AI.Heading

Ready to discuss your project?